I’ve more than eight hundred offices around australia

- The eye Costs toward an investment property Loan was tax deductible, if you’re prominent and you may financing repayments are not.

New taxation deductibility of great interest is the reason why assets eg a keen attractive capital for some. It is because the added possibility of bad gearing’ the capacity to counterbalance losings (partly caused by those people attract write-offs) against most other earnings.

Precisely the interest component truly pertaining to disregard the home is tax-deductible. By paying dominating and you can interest on the loan, make an effort to calculate the eye parts from year to year built in your mortgage comments.

Including desire relating to the possessions buy, you may allege a beneficial deduction getting attention to the financing removed out over:

- complete renovations;

- get depreciating possessions (particularly: furniture); otherwise

- build fixes otherwise manage maintenance.

Deductions usually are not said to have attract toward fund removed to get homes on which a house is going to be oriented (i.e. bare belongings). Write-offs are merely claimable in the event that home is complete, being ended up selling for rent.

On a yearly basis, the ATO centers good-sized review craft into states to own appeal write-offs as most of them try completely wrong. Here are some of the prominent traps and a few approaches for maximising your allege.

Dont blend financial support and private borrowings

It’s preferred to own financial institutions giving redraw establishment facing existing fund, and therefore people either used to pick investment functions. Such as for instance a great redraw may be used to have income-promoting objectives, non-income-creating objectives otherwise a mix of both. On second case, the attention into loan have to be apportioned within deductible and you can non-allowable elements, towards split highlighting new amounts borrowed with the leasing possessions while the loan amount to have private aim.

As a general rule, prevent blend mortgage levels with both deductible and you may low-allowable section as they can be difficult to precisely work out the latest separated.

In past times, so-called separated fund have been common, in which a loan was taken out having you to parts maintenance an investment property and another parts upkeep a personal credit (e.grams. a mortgage on house). It was therefore possible to help you channel all bucks money facing the private credit (where in actuality the desire isnt tax-deductible) while keeping an ever growing balance to your capital an element of the mortgage (the spot where the appeal try deductible). The latest ATO has actually due to the fact questioned so it plan inside judge, which has created this tactic have just like the end up being banned, which can be don’t allowed.

Although not, you can easily sign up for a few loans with the exact same lender, for each was able individually: one in regards to this new financing and one in relation to the personal assets. By creating deeper costs resistant to the individual financing, a similar income tax result is possible just as in brand new split-mortgage plan however, from the dramatically reduced income tax risk.

Example: Barbara refinances their investment property and her home along with her bank. She removes an attraction-just mortgage to your money spent and you will will pay minimal called for to get to know their own requirements toward bank. She removes a principal-and-interest mortgage on home and you may maximises their repayments most of the few days in order to reduce the principal a great (so because of this, over time, slow down the non-deductible notice costs).

Get the very best tax benefit if you are paying down borrowings on the domestic, not their rental assets

Whether your bucks reserves are looking fit, you may want to take advantage of out-of you to a lot more https://clickcashadvance.com/installment-loans-wi/hammond/ dollars. It’s a good idea to pay off obligations, in addition to borrowings on functions. Although not, while the investment property mortgage attention are tax-deductible and you may attention with the your personal home loan is not tax-deductible, it makes a whole lot more sense to blow down the financing into the your home very first.

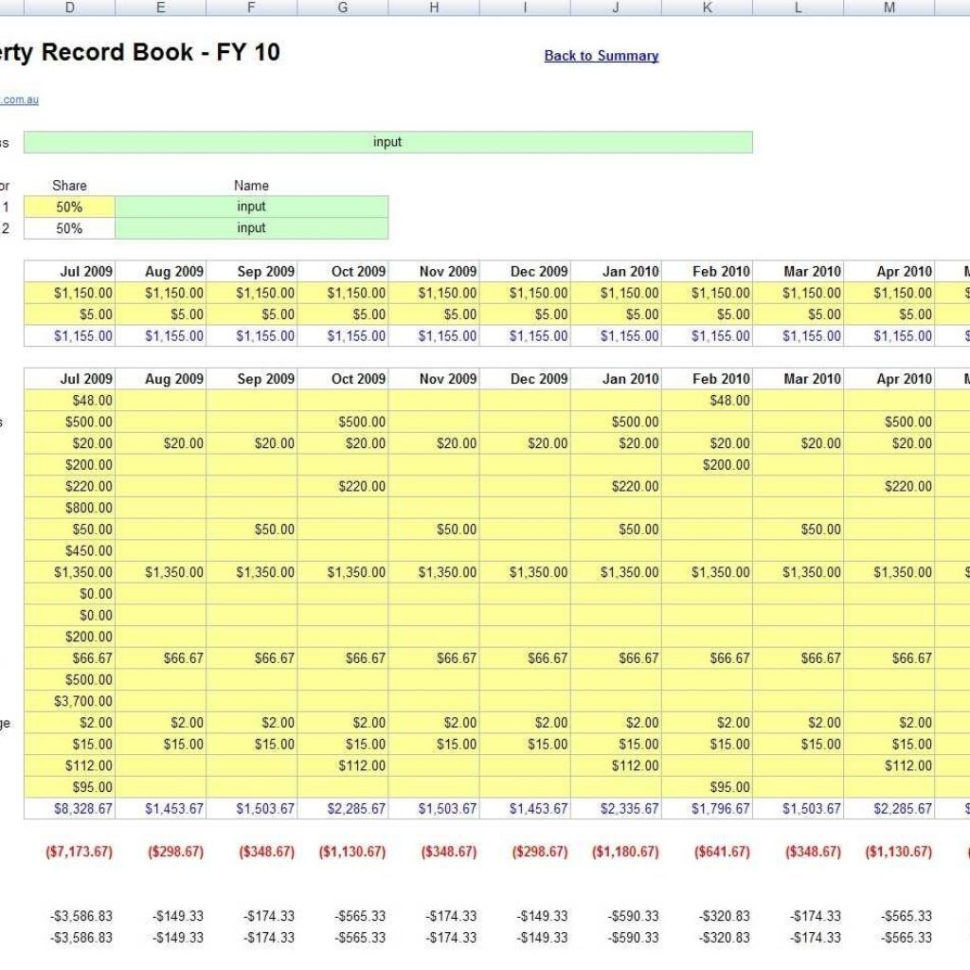

Make sure notice says try separated safely to your jointly had properties

Interest expenses need to be designated amongst co-customers prior to its judge need for the property. In the case of combined tenants (the common circumstance around spouses who purchase to each other), it means . Don’t you will need to skew deduction claims to work with the higher generating lover.

If you purchase property with folks since the tenants-inside common’ (plain old condition where unconnected parties interact so you’re able to jointly pick property), for each and every proprietor can have uneven interests equal in porportion on the value of the resource. The brand new claim to possess desire deductions need to still be in line with whichever its court need for the home was, as stated to the title deed.

If property is actually you to term just although financing is within joint names (and therefore are not arises where the financial need a spouse getting a mutual cluster on financing to loans a beneficial sufficiently large credit), brand new courtroom manager of the home can still allege the full deduction for all of your own attract. As an alternative, imagine obtaining almost every other partner to behave because the guarantor with the mortgage as opposed to joint borrower.

In the event the property is within the joint labels but only 1 name is on the borrowed funds, for every joint holder normally allege the display of one’s focus.

Example: Richard and Dawn, a married few, purchase a residential property as the mutual renters, resource the purchase because of that loan that is during the Richard’s identity only. Not surprisingly, one another Richard and you may Start is claim fifty% of one’s attention towards loan because the taxation deductions.